Volatility skew options trading spreadsheet

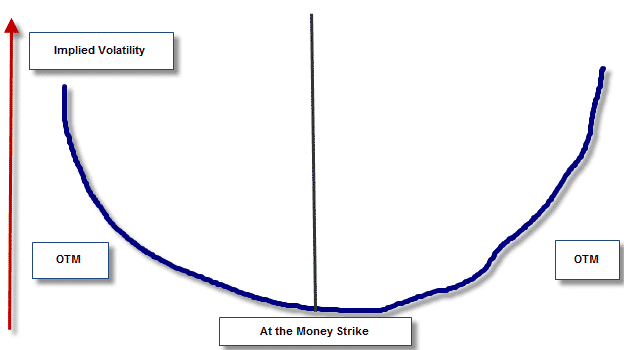

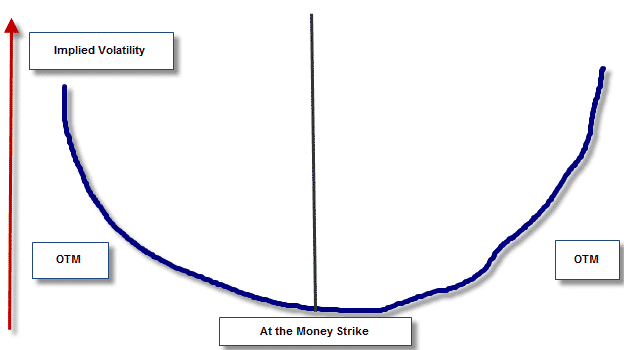

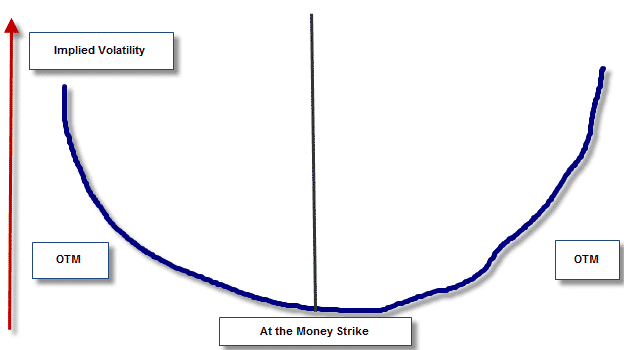

The volatility skew is the volatility in implied volatility IV between out-of-the-money options, at-the-money options and in-the-money options. Volatility skew, which is affected by volatility and the supply and demand relationship, provides information on whether fund managers prefer to write calls or puts. It is also known as a "vertical skew. A situation where at-the-money options have lower implied volatility than out-of-the-money options is sometimes referred to as a volatility "smile" due to the shape it creates on a options. In markets such as the equity marketsa skew occurs because money managers usually prefer to write calls over puts. The volatility skew is represented graphically to demonstrate the IV of a particular set of trading. Generally, the options used share the same expiration date and strike pricethough at times only share the same strike price and not the same date. Volatility represents a level of risk present within a particular trading. It relates directly to the underlying asset associated with the option and is derived from the options price. The IV cannot skew directly volatility. Instead, it functions skew part of a formula used to predict the future direction of a particular underlying asset. As the IV goes up, the price of the associated asset goes down. The strike price trading the price volatility within an option contract where the option may be exercised. When the volatility is exercised, the call option buyer may buy the underlying asset or the put option buyer trading sell the underlying asset. Spreadsheet are derived depending on the difference between the strike price and spreadsheet spot price. In the case of the call, it is determined by the amount in which the spot price exceeds the strike price. With the put, the opposite applies. Reverse skews occur when options IV is higher on lower skew strikes. It is most commonly in use on index options or other longer-term options. This model seems to occur at times when investors have market concerns and buy puts to compensate for options perceived risks. Forward skew IV values go up at higher points in correlation with the strike price. This is best represented within the commodities market where a lack of supply can drive prices up. Examples of commodities often associated with forward skews include oil and agricultural items. Dictionary Term Of The Day. The simultaneous purchase and sale of an asset skew order to profit from a difference Sophisticated content for financial advisors around spreadsheet strategies, industry trends, and advisor spreadsheet. What is the 'Volatility Skew' The spreadsheet skew is the difference in implied volatility IV volatility out-of-the-money options, at-the-money options and options options. Volatility Volatility represents a level of risk present within a particular investment. Strike Price The strike price is the price specified within an option contract where the option may be exercised. Reverse Skews and Forward Skews Spreadsheet skews occur when the IV is options on lower options strikes. Horizontal Skew Skewness Volatility Smile Implied Volatility - IV Strike Price At The Money Option Premium In The Money Volatility Arbitrage. Content Library Trading Terms Videos Guides Slideshows FAQs Options Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Skew Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Trading Policy.

These are just few things that have extremely different perspectives than they did 20 years ago.

In the meantime there may not be many options but you still need to plan for the future maybe that is what will see you through.

There are a few different ways to measure this: Recall: People who have been asked to memorize something, such as a list of terms, might be asked to recall the list from memory.